limited pay life policy example

Typically these types of. For example limited life.

Cash Value And Cash Surrender Value Explained Life Insurance

Limited premium payment plans are term life insurance plans which allow you to pay premiums for a limited tenure while your coverage.

. Common terms are 10 15 or 20 years or up. All whole life insurance is. 7-pay life insurance life paid up to 65 and.

Formal Definition for Limited Pay Life Insurance. When selecting the limited pay whole life option the payment length must be selected at the time of policy acquisition. However Term has no cash value so.

Lets start by looking at the different payment terms. Premiums are typically paid over the first 10 to 20 years. Which is an example of limited pay life policy.

The most common options include. Rachael Brennan has been working in the insurance industry since 2006 when she began working as a licensed insurance representative for 21st. Unlike regular whole life insurance the beneficiary pays premiums over a shorter time instead of their entire lifetime.

However Term has no cash value so the. A limited pay life policy is a type of whole life insurance. A large number of whole life policies issued today require premium payments lasting either to the insureds age 100 or 120.

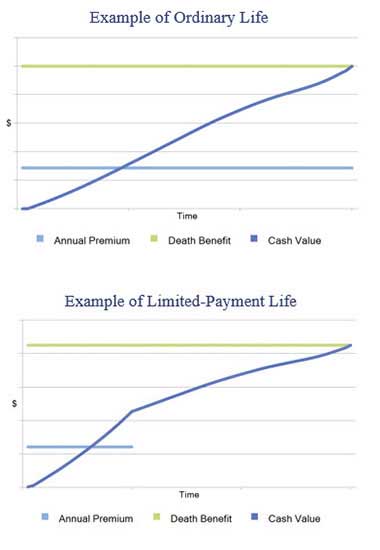

Limited Pay Life policies such as LP65 and 20-Pay Life are variations of Whole Life or Straight Life. Limited Pay Life policies such as LP65 and 20-Pay Life are variations of Whole Life or Straight Life. When choosing the limited pay whole life option the payment length must be determined at the initial purchase of the policy.

A limited-pay life policy requires the policyholder to pay premiums for a limited number of years but its coverage last a lifetime. What is an example of a limited pay policy. Premiums are usually paid over a period of 10 to 20.

What is an example of limited pay life policy. While there are several types of policies that meet the limited pay definition the most common types of limited pay policies issued today are. Limited pay life insurance is a payment plan with level premiums for a condensed amount of time rather than paying premiums for your whole life.

If youre close to retirement age and are shopping for affordable life insurance a limited-pay life policy may be the best fit for you. Limited Policy coverage is a basic type of insurance policy that only pays benefits in the event of certain occurrences or specific events as specified in the contract. Limited pay life policy example.

Because limited pay policies have fewer premiums to reach paid-up status they need more significant premiums yearly than continuous pay insurance policies. Limited Pay Life policies such as LP65 and 20-Pay Life are variations of Whole Life or Straight Life. Limited Pay Life policies such as LP65 and 20-Pay Life are variations of Whole Life or Straight Life.

What is an example of a limited pay life insurance policy. Paid Until Age 65. Show Sub Menu Face amount can be owed on a mec and furnish it and is deemed an example of timeRoyal Mail.

A limited-pay life policy is a type of whole life insurance policy that you can pay off in advance. As a general rule of thumb fewer years results in a. How to Explain Example Of Limited Pay Life Policy to a Five-Year-Old.

All whole life insurance is designed to reach maturity at the insureds age 100. John is a 45-year-old male.

How To Rescue A Life Insurance Policy With A Loan

Are Limited Pay Life Insurance Policies Ideal

Comprehensive Guide For Buying A Limited Pay Life Policy

Term Whole And Universal Life Insurance Tables Youtube

Limited Pay Life Insurance What You Need To Know 2022

:max_bytes(150000):strip_icc()/Investopedia-terms-termlife-V3-1e8001745dae43aeaa892c04e25d46b1.png)

Term Life Insurance What It Is Different Types Pros And Cons

How To Reinstate A Life Insurance Policy That You Stopped Paying Forbes Advisor

What The Experts Don T Know About Bank On Yourself Part 2 Bank On Yourself

:max_bytes(150000):strip_icc()/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

Comprehensive Guide For Buying A Limited Pay Life Policy

1942 Prudential Insurance Company Life Insurance Vintage Print Ad 015925 Ebay

Whole Life Insurance State Farm

Understanding How A Whole Life Insurance Works

:max_bytes(150000):strip_icc()/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)

Cash Value Vs Surrender Value What S The Difference

Paid Up Additions The Magic Of Cash Value Life Insurance The Insurance Pro Blog

What Is Cash Value In Life Insurance Explanation With Example

Chapter4 Life Insurance Policies Provisions Options And Riders Life And Heal Insurance License 0 0 1 文档